Page 4 - SGH Profit Sharing & 401(k) Plan and Trust

P. 4

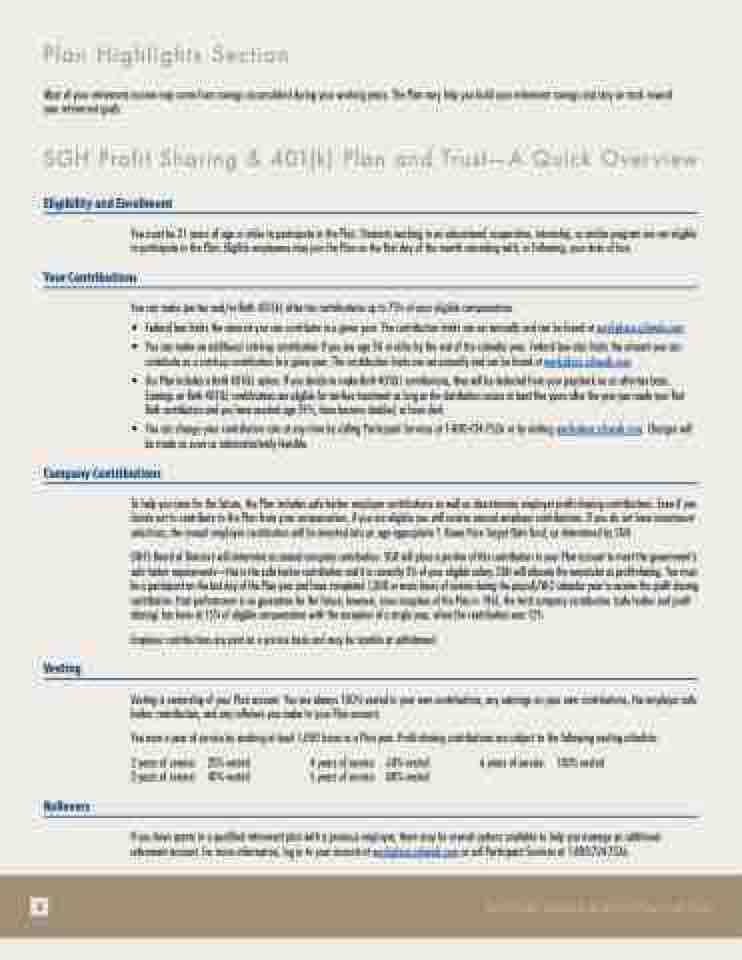

Plan Highlights Section Most of your retirement income may come from savings accumulated during your working years. The Plan may help you build your retirement savings and stay on track toward your retirement goals. SGH Profit Sharing & 401(k) Plan and Trust—A Quick Overview Eligibility and Enrollment You must be 21 years of age or older to participate in the Plan. Students working in an educational cooperative, internship, or similar program are not eligible to participate in the Plan. Eligible employees may join the Plan on the first day of the month coinciding with, or following, your date of hire. Your Contributions You can make pre-tax and/or Roth 401(k) after-tax contributions up to 75% of your eligible compensation. • Federallawlimitstheamountyoucancontributeinagivenyear.Thecontributionlimitsaresetannuallyandcanbefoundatworkplace.schwab.com. • You can make an additional catch-up contribution if you are age 50 or older by the end of the calendar year. Federal law also limits the amount you can contribute as a catch-up contribution in a given year. The contribution limits are set annually and can be found at workplace.schwab.com. • OurPlanincludesaRoth401(k)option.IfyoudecidetomakeRoth401(k)contributions,theywillbedeductedfromyourpaycheckonanafter-taxbasis. Earnings on Roth 401(k) contributions are eligible for tax-free treatment as long as the distribution occurs at least five years after the year you made your first Roth contribution and you have reached age 591⁄2, have become disabled, or have died. • YoucanchangeyourcontributionrateatanytimebycallingParticipantServicesat1-800-724-7526orbyvisitingworkplace.schwab.com.Changeswill be made as soon as administratively feasible. Company Contributions Vesting Rollovers To help you save for the future, the Plan includes safe harbor employer contributions as well as discretionary employer profit-sharing contributions. Even if you decide not to contribute to the Plan from your compensation, if you are eligible you will receive annual employer contributions. If you do not have investment selections, the annual employer contribution will be invested into an age-appropriate T. Rowe Price Target Date fund, as determined by SGH. SGH’s Board of Directors will determine an annual company contribution. SGH will place a portion of this contribution in your Plan account to meet the government’s safe harbor requirements—this is the safe harbor contribution and it is currently 3% of your eligible salary. SGH will allocate the remainder as profit-sharing. You must be a participant on the last day of the Plan year and have completed 1,000 or more hours of service during the payroll/W-2 calendar year to receive the profit sharing contribution. Past performance is no guarantee for the future; however, since inception of the Plan in 1961, the total company contribution (safe harbor and profit sharing) has been at 15% of eligible compensation with the exception of a single year, when the contribution was 12%. Employer contributions are paid on a pre-tax basis and may be taxable at withdrawal. Vesting is ownership of your Plan account. You are always 100% vested in your own contributions, any earnings on your own contributions, the employer safe harbor contribution, and any rollovers you make to your Plan account. You earn a year of service by working at least 1,000 hours in a Plan year. Profit-sharing contributions are subject to the following vesting schedule: 2 years of service: 20% vested 4 years of service: 60% vested 6 years of service: 100% vested 3 years of service: 40% vested 5 years of service: 80% vested If you have assets in a qualified retirement plan with a previous employer, there may be several options available to help you manage an additional retirement account. For more information, log in to your account at workplace.schwab.com or call Participant Services at 1-800-724-7526. 4 SGH Profit Sharing & 401(k) Plan and Trust