Page 4 - Sonepar USA 401(k) Plan education guide

P. 4

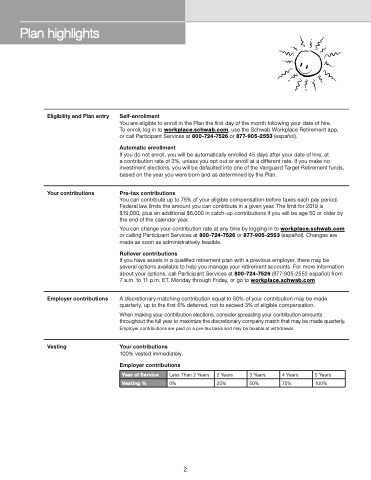

Plan highlights

Eligibility and Plan entry

Your contributions

Self-enrollment

You are eligible to enroll in the Plan the first day of the month following your date of hire. To enroll, log in to workplace.schwab.com, use the Schwab Workplace Retirement app, or call Participant Services at 800-724-7526 or 877-905-2553 (español).

Automatic enrollment

If you do not enroll, you will be automatically enrolled 45 days after your date of hire, at

a contribution rate of 3%, unless you opt out or enroll at a different rate. If you make no investment elections, you will be defaulted into one of the Vanguard Target Retirement funds, based on the year you were born and as determined by the Plan.

Pre-tax contributions

You can contribute up to 75% of your eligible compensation before taxes each pay period. Federal law limits the amount you can contribute in a given year. The limit for 2019 is $19,000, plus an additional $6,000 in catch-up contributions if you will be age 50 or older by the end of the calendar year.

You can change your contribution rate at any time by logging in to workplace.schwab.com or calling Participant Services at 800-724-7526 or 877-905-2553 (español). Changes are made as soon as administratively feasible.

Rollover contributions

If you have assets in a qualified retirement plan with a previous employer, there may be several options available to help you manage your retirement accounts. For more information about your options, call Participant Services at 800-724-7526 (877-905-2553 español) from 7 a.m. to 11 p.m. ET, Monday through Friday, or go to workplace.schwab.com

A discretionary matching contribution equal to 50% of your contribution may be made quarterly, up to the first 6% deferred, not to exceed 3% of eligible compensation.

When making your contribution elections, consider spreading your contribution amounts throughout the full year to maximize the discretionary company match that may be made quarterly. Employer contributions are paid on a pre-tax basis and may be taxable at withdrawal.

Employer contributions

Vesting

Your contributions

100% vested immediately.

Employer contributions

Year of Service Less Than 2 Years Vesting % 0%

2

2 Years 25%

3 Years 50%

4 Years 75%

5 Years 100%