Page 12 - American Century Retirement Plan Enrollment Guide

P. 12

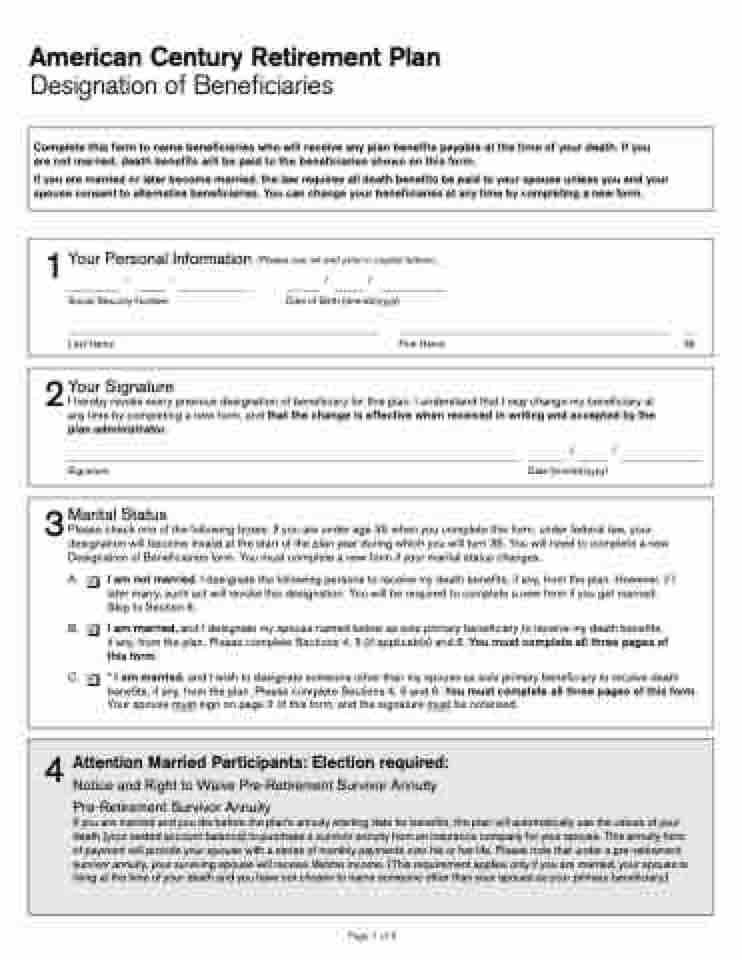

American Century Retirement Plan

Designation of Beneficiaries

Complete this form to name beneficiaries who will receive any plan benefits payable at the time of your death. If you are not married, death benefits will be paid to the beneficiaries shown on this form.

If you are married or later become married, the law requires all death benefits be paid to your spouse unless you and your spouse consent to alternative beneficiaries. You can change your beneficiaries at any time by completing a new form.

1Your Personal Information (Please use ink and print in capital letters.) -- //

Social Security Number Date of Birth (mm/dd/yyyy)

Last Name First Name MI

2Your Signature

I hereby revoke every previous designation of beneficiary for this plan. I understand that I may change my beneficiary at any time by completing a new form, and that the change is effective when received in writing and accepted by the plan administrator.

// Signature Date (mm/dd/yyyy)

3Marital Status

Please check one of the following boxes. If you are under age 35 when you complete this form, under federal law, your designation will become invalid at the start of the plan year during which you will turn 35. You will need to complete a new Designation of Beneficiaries form. You must complete a new form if your marital status changes.

A. ❑ I am not married. I designate the following persons to receive my death benefits, if any, from the plan. However, if I later marry, such act will revoke this designation. You will be required to complete a new form if you get married. Skip to Section 6.

B. ❑ I am married, and I designate my spouse named below as sole primary beneficiary to receive my death benefits, if any, from the plan. Please complete Sections 4, 5 (if applicable) and 6. You must complete all three pages of this form.

C. ❑ * I am married, and I wish to designate someone other than my spouse as sole primary beneficiary to receive death benefits, if any, from the plan. Please complete Sections 4, 5 and 6. You must complete all three pages of this form. Your spouse must sign on page 2 of this form, and the signature must be notarized.

4 Attention Married Participants: Election required:

Notice and Right to Waive Pre-Retirement Survivor Annuity

Pre-Retirement Survivor Annuity

If you are married and you die before the plan’s annuity starting date for benefits, the plan will automatically use the values of your death (your vested account balance) to purchase a survivor annuity from an insurance company for your spouse. This annuity form of payment will provide your spouse with a series of monthly payments over his or her life. Please note that under a pre-retirement survivor annuity, your surviving spouse will receive lifetime income. (This requirement applies only if you are married, your spouse is living at the time of your death and you have not chosen to name someone other than your spouse as your primary beneficiary.)

Page 1 of 3