Page 10 - American Century Retirement Plan Enrollment Guide

P. 10

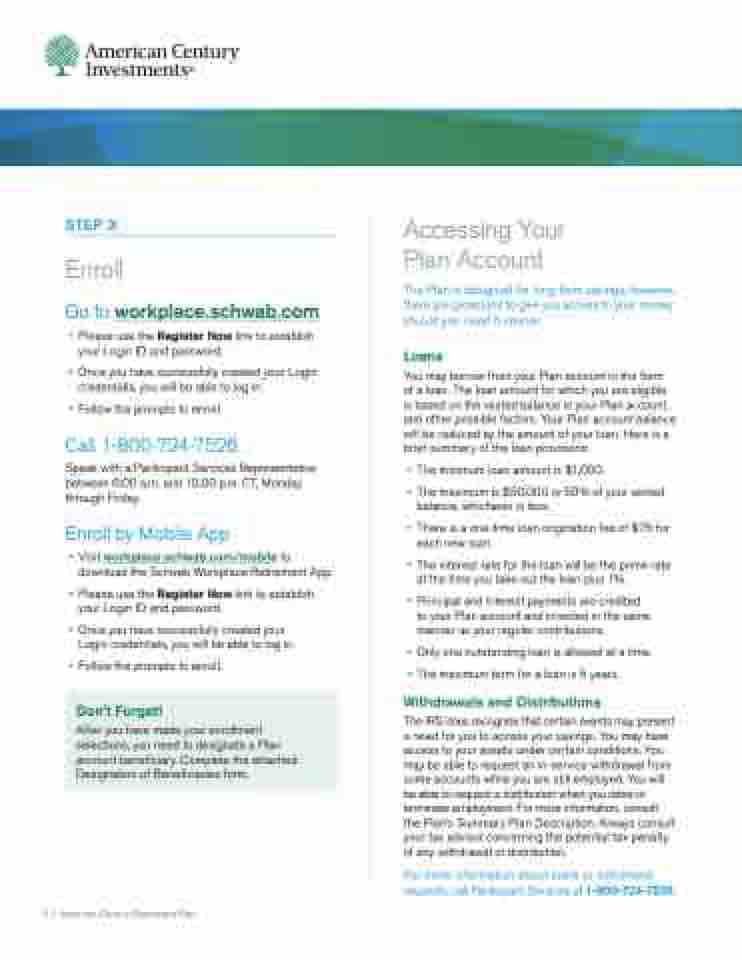

STEP 3:

Enroll

Go to workplace.schwab.com

• Please use the Register Now link to establish

your Login ID and password.

• Once you have successfully created your Login credentials, you will be able to log in.

• Follow the prompts to enroll. Call 1-800-724-7526

Speak with a Participant Services Representative between 6:00 a.m. and 10:00 p.m. CT, Monday through Friday.

Enroll by Mobile App

• Visit workplace.schwab.com/mobile to download the Schwab Workplace Retirement App.

• Please use the Register Now link to establish your Login ID and password.

• Once you have successfully created your Login credentials, you will be able to log in.

• Follow the prompts to enroll.

Accessing Your Plan Account

The Plan is designed for long-term savings; however, there are provisions to give you access to your money should you need it sooner.

Loans

You may borrow from your Plan account in the form of a loan. The loan amount for which you are eligible is based on the vested balance in your Plan account, and other possible factors. Your Plan account balance will be reduced by the amount of your loan. Here is a brief summary of the loan provisions:

•

•

•

•

•

•

•

The minimum loan amount is $1,000.

The maximum is $50,000 or 50% of your vested balance, whichever is less.

There is a one-time loan origination fee of $75 for each new loan.

The interest rate for the loan will be the prime rate at the time you take out the loan plus 1%.

Principal and interest payments are credited to your Plan account and invested in the same manner as your regular contributions.

Only one outstanding loan is allowed at a time. The maximum term for a loan is 5 years.

Don’t Forget!

After you have made your enrollment selections, you need to designate a Plan account beneficiary. Complete the attached Designation of Beneficiaries form.

8 | American Century Retirement Plan

Withdrawals and Distributions

The IRS does recognize that certain events may present a need for you to access your savings. You may have access to your assets under certain conditions. You may be able to request an in-service withdrawal from some accounts while you are still employed. You will be able to request a distribution when you retire or terminate employment. For more information, consult the Plan’s Summary Plan Description. Always consult your tax advisor concerning the potential tax penalty of any withdrawal or distribution.

For more information about loans or withdrawal requests, call Participant Services at 1-800-724-7526.