Page 4 - American Century Retirement Plan Enrollment Guide

P. 4

Start Early. It’s Important.

The Power of Compounding

Although it is never too late to start saving for retirement, starting early is one way to help build retirement savings. By starting early, you take advantage of the opportunity for potential compounding of investment earnings over

a longer period of time.

Time Is Money

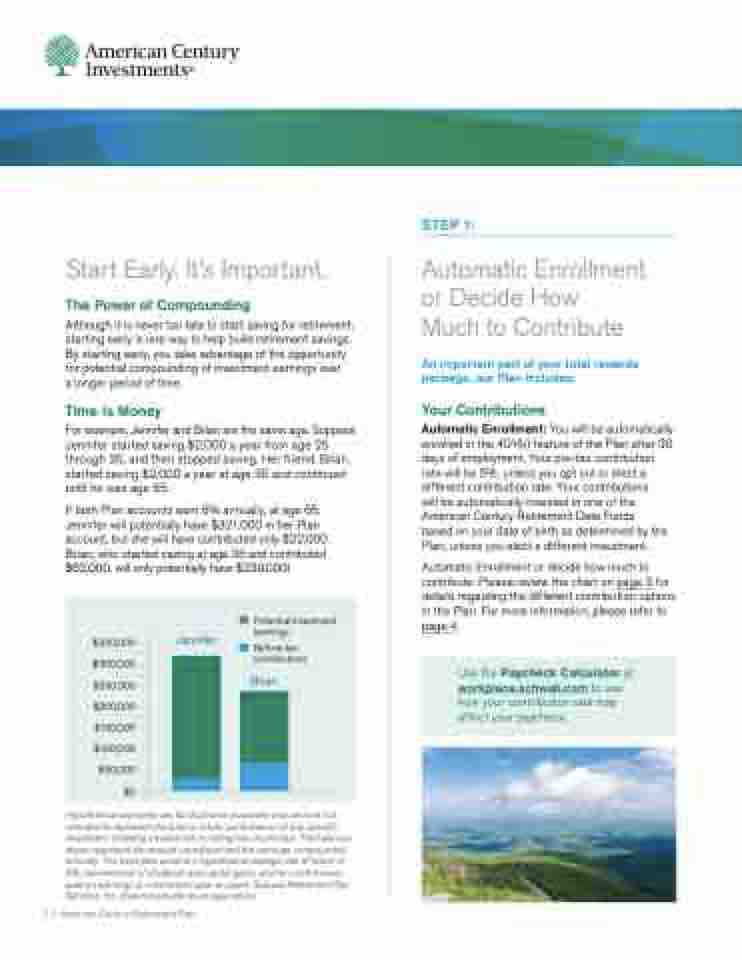

For example, Jennifer and Brian are the same age. Suppose Jennifer started saving $2,000 a year from age 25 through 35, and then stopped saving. Her friend, Brian, started saving $2,000 a year at age 35 and continued until he was age 65.

If both Plan accounts earn 8% annually, at age 65, Jennifer will potentially have $321,000 in her Plan account, but she will have contributed only $22,000. Brian, who started saving at age 35 and contributed $62,000, will only potentially have $239,000!

STEP 1:

Automatic Enrollment or Decide How

Much to Contribute

An important part of your total rewards package, our Plan includes:

Your Contributions

Automatic Enrollment: You will be automatically enrolled in the 401(k) feature of the Plan after 30 days of employment. Your pre-tax contribution rate will be 5%, unless you opt out or elect a different contribution rate. Your contributions

will be automatically invested in one of the American Century Retirement Date Funds based on your date of birth as determined by the Plan, unless you elect a different investment.

Automatic Enrollment or decide how much to contribute: Please review the chart on page 3 for details regarding the different contribution options in the Plan. For more information, please refer to page 4.

Potential investment earnings

$350,000 $300,000 $250,000 $200,000 $150,000 $100,000

$50,000 $0

Jennifer

Brian

Before-tax contributions

Hypothetical examples are for illustrative purposes only and are not intended to represent the past or future performance of any specific investment. Investing involves risk including loss of principal. The balances shown represent the amount contributed and the earnings compounded annually. The examples assume a hypothetical average rate of return of 8%, reinvestment of dividends and capital gains, and no current taxes paid on earnings in a retirement plan account. Schwab Retirement Plan Services, Inc. does not provide tax or legal advice.

2 | American Century Retirement Plan

Use the Paycheck Calculator at workplace.schwab.com to see how your contribution rate may affect your paycheck.