Q: How can I save for my kids’ college without derailing my retirement?

Saving for college is no easy task in the face of all the other costs of raising children. Once you’ve paid all the bills and put something aside for college, it can seem like there’s no money left for you, let alone anything extra to add to your retirement account. But here’s where you have to take a step back. Can you really afford to think of your retirement as an extra?

While I know it goes against the grain of being a parent, when it comes to retirement, you have to put yourself first. It’s kind of like the airline emergency instructions to position your own oxygen mask before you help your child. In other words, you won’t be of much use to your child or anyone else if you don’t take care of yourself. Now this doesn’t mean you have to completely sacrifice one savings goal for the other. It just means that you have to stay true to your retirement savings plan while looking realistically at all the choices you have for handling college costs.

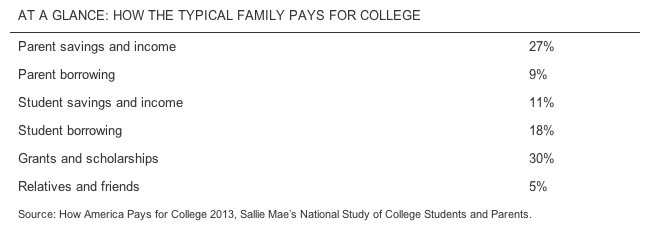

A national Sallie Mae study, How America Pays for College 2013, found that the typical family covered just 27 percent of their kids’ college costs through savings and income in 2012–13. So how did they cover the rest? Through a patchwork of scholarships, grants, student loans, gifts, and the students’ own income.

Smart Move: Prioritize your savings. Review “Saving Fundamentals” on page 5. Notice that saving for college is number 5—after contributing to your 401(k), creating an emergency fund, getting out of debt, and saving even more for retirement.

Be Tax-Smart About Saving for College

Hopefully you’re taking full advantage of your employer’s retirement plan as well as saving more if you can in a traditional or Roth IRA. Just as these are tax-smart ways to save for retirement, there are tax-smart ways to save for college. Here are the two main choices:

- 529 plans—A 529 plan is a state-sponsored, tax-advantaged way for parents, relatives, and friends to save and invest for a child’s college education. Most states offer at least one 529 plan, but you don’t have to live in a state to participate in that state’s 529 plan. While plans differ in terms of costs, features, and investment selections, and some plans provide tax benefits to in-state residents, the federal tax benefits are the same:

- Tax-free growth—All earnings are free from federal income tax, so your investment has the potential to grow at an even faster pace than it would in a taxable account.

- Tax-free withdrawals—You pay no federal taxes on withdrawals as long as they’re used for qualified education expenses (for example, tuition, fees, books, room and board).

- Special gift tax exclusion—You can contribute a lump sum of up to $70,000 ($140,000 per couple) and make five years of contributions for each beneficiary in a single year without incurring the gift tax (based on 2013 annual per-individual limit of $14,000). Once you’ve done this, though, any additional gifts to that individual in the next five years would be subject to the gift tax.

- High contribution limits—Although they vary by state plan, there are generally much higher contribution limits for 529 plans than for other education savings options.

Smart Move: A 529 plan is a great way for grandparents to contribute to their grandchild’s college fund.

-

- An added benefit of a 529 plan is that you control the account. The funds can be used for qualified education expenses, but they never become the direct property of the beneficiary. Plus you can change the beneficiary to any eligible family member of the current beneficiary at any time.

Smart Move: Before you choose a 529 plan, check to see if your home state’s plan offers a state income tax deduction on contributions for state residents.

- Education Savings Accounts—ESAs, also known as Coverdell Education Savings Accounts, offer tax-free growth and tax-free withdrawals like a 529 plan. But unlike a 529 plan, withdrawals can be used for qualified elementary and secondary education expenses as well as for college costs. However, an ESA isn’t for everyone. There are qualifications and restrictions you need to consider:

- Only couples with adjusted gross incomes of less than $220,000 are eligible to open and contribute to ESAs (less than $110,000 for individuals).

- Contributions are limited to a maximum of $2,000 per year until the beneficiary’s 18th birthday. That maximum assumes a modified adjusted gross income less than $95,000 (less than $190,000 for married couples filing jointly) and is gradually reduced above that level.

- The account must be liquidated at age 30; however, the designated beneficiary may roll over the full balance to a different Coverdell ESA for another family member, thus potentially avoiding taxes and penalties.

Smart Move: Want to be a super-saver? Contribute to both a 529 plan and an ESA.

For the record, you can also save for a child’s education in a custodial account, but there are minimal tax advantages. Also, the money becomes the property of the child as soon as he or she reaches 18, 21, or 25, depending on the state. (Do you really want to fund that trip to Tahiti or that new car?) In my opinion, a 529 plan offers the best in tax advantages, control, and flexibility. See the following chart for a more detailed comparison of 529s and ESAs.

| 529 Plan | Coverdell Education Savings Account | |

|---|---|---|

| Description | A state-sponsored tax-deferred college investment program that can be set up by anyone—parent, relative, or friend | An ESA set up and managed by a parent or guardian for the benefit of a minor |

| Earnings | Tax-deferred | Tax-deferred |

| Amount that can be contributed gift-tax-free | Up to $70,000 ($140,000 per couple) per beneficiary in a single year if the contributor elects to recognize that gift over five years for tax purposes and makes no additional gifts to that beneficiary over the next five years | N/A |

| Withdrawals | Federal-tax-free when used for qualified postsecondary education expenses | Federal-tax-free when used for qualified elementary, secondary, and postsecondary education expenses |

| Contribution limits | Lifetime limit per beneficiary that varies by state, generally upward of $200,000 per beneficiary | $2,000 per year, subject to adjusted gross income limitations (phase-out: $190,000–$220,000, married filing jointly; $95,000–$110,000, single) |

| Penalty for nonqualified use | Earnings taxed as ordinary income and may be subject to a 10% federal penalty | Earnings taxed as ordinary income and may be subject to a 10% federal penalty |

| Investment choices | Choice of investment portfolios that are chosen by state’s plan administrator | Investment choices up to parent or guardian |

| Impact on financial aid | Counted as assets of parent or account owner; minimal impact on financial aid | Counted as assets of parent or account owner; minimal impact on financial aid |

| Beneficiaries | No age limit on beneficiaries; can change beneficiary at any time | Beneficiary must be under 18; all assets must be distributed or transferred to an eligible beneficiary by child’s 30th birthday |

| Note: Data are for 2013. | ||

Smart Move: Once you have a child in college, be sure to talk to your tax advisor about available college tax credits and deductions.

Research—and Apply for—All Financial Aid

A lot of parents make the mistake of thinking their kids won’t qualify for financial aid—and make the even bigger mistake of not applying for it. But whether it’s through private scholarships or government grants and loans, there’s a considerable amount of financial help out there—and not all of it is asset based.

According to the College Board, in 2011–12, full-time undergraduate students received an average of $13,218 per student in financial aid from a combination of federal loans and other sources. That’s pretty encouraging.

Equally encouraging is the fact that the U.S. Department of Education has made the Free Application for Federal Student Aid (FAFSA) process more streamlined and easier to navigate. Consider, too, that in FAFSA calculations, only 5.64 percent of parents’ assets are considered available for college expenses. There’s also an asset protection allowance (which increases as the parents age), so a certain percentage of assets won’t be counted. Retirement accounts and the value of your primary residence are also excluded.

Another factor that increases eligibility for aid is how many kids you have in college at the same time. If you have more than one child in college, this can work in your favor in terms of financial aid. So don’t hesitate to factor financial aid into your college saving equation.

Smart Move: As your kids approach college age, be sure to check out sites like finaid.org or collegeboard.org for more information on planning and paying for college.

Take Advantage of Student Loans

There’s a lot written about the burden of student debt these days, and there’s no denying that paying back student loans can be an albatross for many years if not managed wisely. But today, student loans are a fact of life and a viable way to pay for an education. According to a report by the Joint Economic Committee of the U.S. Congress, two-thirds of the class of 2012 had student loans on graduation, with an average balance of just over $27,000.

I’m not suggesting that you have to saddle your kids with debt. But if what you can save for college comes up short, you could finance a certain percentage of college costs through student loans (ideally federal) and help your kids pay them back over time.

Get the Kids to Help

There’s nothing that says you have to do all the saving yourself. Get your kids involved early on. Encourage them to get a summer job and put a percentage of their earnings toward college. Once they’re in school, suggest the possibility of working part-time during the school year.

It’s not unusual for kids to contribute toward their education. According to a 2013 study by Sallie Mae, students pay about 11 percent of college costs from their own savings and income, and the U.S. Census Bureau reports that in 2011 the majority of undergraduates—72 percent—worked during the year.

You could also suggest that a portion of any monetary gifts go toward a college account. Speaking of gifts, when grandparents or other relatives want to buy something for your kids, suggest a contribution toward their education. It all adds up!

| Parent savings and income | 27% |

| Parent borrowing | 9% |

| Student savings and income | 11% |

| Student borrowing | 18% |

| Grants and scholarships | 30% |

| Relatives and friends | 5% |

| Source: How America Pays for College 2013, Sallie Mae’s National Study of College Students and Parents. | |

Don’t Use Retirement Accounts for College Savings

A 2013 study by Sallie Mae, How America Saves for College, revealed some disturbing trends. In a survey looking into the types of accounts the typical family uses to save for college, 17 percent listed retirement accounts! To me this just doesn’t make sense.

First, if you withdraw money from your 401(k) to pay for your child’s educational expenses before you’re 59½, you will have to pay a 10 percent penalty on that money—on top of income taxes. You’re not hit with the penalty if you withdraw educational money from your IRA, but you will have to pay taxes. In other words, those withdrawals for college costs are going to add to your tax bill! A 529 account makes much more tax sense because any earnings grow tax-free and withdrawals are tax-free when used for qualified education expenses.

But perhaps even more important, if you raid your retirement savings to pay for college, you’re selling yourself short. Remember, you can’t borrow money to fund your retirement, but most students are eligible for some form of financial aid. Make sure you’re maxing out your retirement accounts first (and don’t touch that money), then prioritize your other savings goals and contribute appropriately. (See the “Saving Fundamentals,” page 5.)

When your kids have graduated and are on their own, they’ll be doubly grateful that you’ve not only helped them through college, but have taken care of yourself as well.

Part I: When Retirement Is at Least Ten Years Out, Question 3

Additional excerpts

- I just retired. What’s the smartest way to draw income from my portfolio?

- Does it make sense to borrow from my 401(k) if I need cash?

- When should I file for Social Security benefits?

- Should I be debt-free before I retire?

- My husband has no interest in our finances. How can I get him involved?

- I’m confused about how to divide my estate between my children, who have different needs and financial resources. Is it best to divide it into equal parts?

- My 20-something child has decided that she wants to move back home. I like my new empty-nest lifestyle, but I want to help her out. How can I balance these?