Page 11 - Latham & Watkins 401(k) Savings and Profit Sharing Plan

P. 11

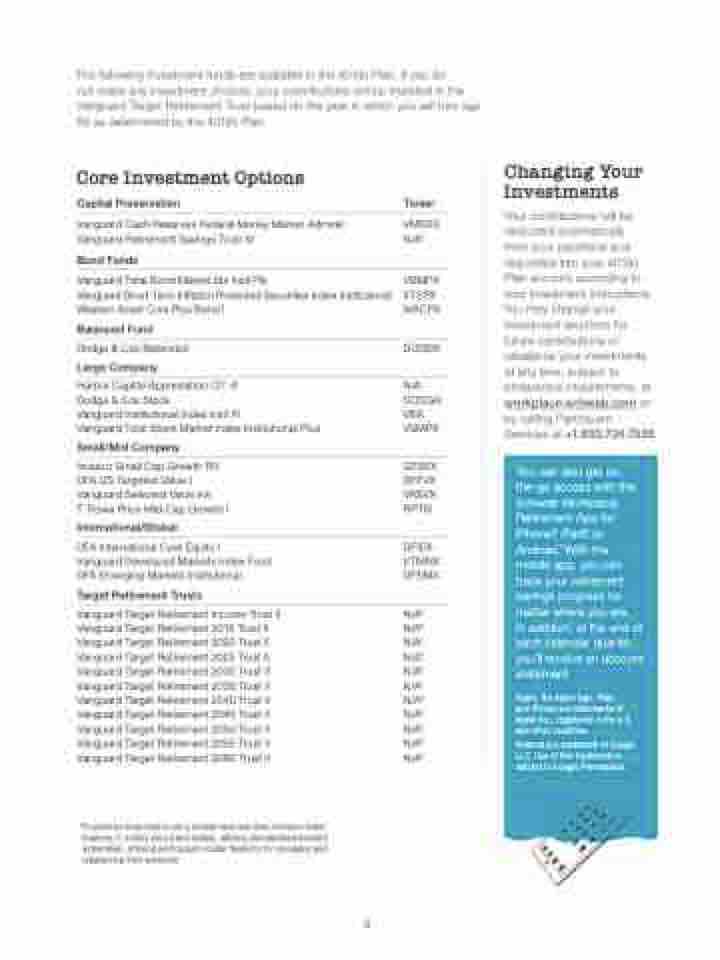

The following investment funds are available in the 401(k) Plan. If you do

not make any investment choices, your contributions will be invested in the Vanguard Target Retirement Trust based on the year in which you will turn age 65 as determined by the 401(k) Plan.

Core Investment Options

Capital Preservation Ticker

Vanguard Cash Reserves Federal Money Market Admiral VMRXX Vanguard Retirement Savings Trust IV N/A*

Bond Funds

Vanguard Total Bond Market Idx Instl Pls VBMPX Vanguard Short-Term Inflation Protected Securities Index Institutional VTSPX

Changing Your Investments

Your contributions will be deducted automatically from your paycheck and deposited into your 401(k) Plan account according to your investment instructions.

Western Asset Core Plus Bond I

Balanced Fund

Dodge & Cox Balanced

Large Company

Harbor Capital Appreciation CIT 42

Dodge & Cox Stock

Vanguard Institutional Index Instl Pl

Vanguard Total Stock Market Index Institutional Plus

Small/Mid Company

Invesco Small Cap Growth R5 DFA US Targeted Value I Vanguard Selected Value Inv

T. Rowe Price Mid-Cap Growth I

International/Global

DFA International Core Equity I

Vanguard Developed Markets Index Fund DFA Emerging Markets Institutional

Target Retirement Trusts

Vanguard Target Retirement Income Trust II Vanguard Target Retirement 2015 Trust II Vanguard Target Retirement 2020 Trust II Vanguard Target Retirement 2025 Trust II Vanguard Target Retirement 2030 Trust II Vanguard Target Retirement 2035 Trust II Vanguard Target Retirement 2040 Trust II Vanguard Target Retirement 2045 Trust II Vanguard Target Retirement 2050 Trust II Vanguard Target Retirement 2055 Trust II Vanguard Target Retirement 2060 Trust II

*A collective trust fund is not a mutual fund and does not have ticker, however, it is daily priced and traded, utilizing standardized industry automation, offering participants similar flexibility for managing and rebalancing their accounts.

WACPX You may change your investment elections for

9

DODBX

N/A DODGX VIIIX VSMPX

GTSVX DFFVX VASVX RPTIX

future contributions or rebalance your investments at any time, subject to prospectus requirements, at workplace.schwab.com or by calling Participant Services at +1.800.724.7526.

You can also get on- the-go access with the Schwab Workplace Retirement App for iPhone®, iPad®, or

DFIEX AndroidTM. With the

VTMNX DFEMX

N/A*

N/A* In addition, at the end of N/A* each calendar quarter, N/A*

N/A*

N/A*

N/A*

N/A*

N/A* and other countries.

N/A* Android is a trademark of Google

N/A*

LLC. Use of this trademark is subject to Google Permissions.

mobile app, you can track your retirement savings progress no matter where you are.

you’ll receive an account statement.

Apple, the Apple logo, iPad,

and iPhone are trademarks of Apple Inc., registered in the U.S.